Knowledge base

February 07, 2022

Jeff Bezos is £14bn richer but Mark Zuckerberg loses £23bn

Jeff Bezos was more than £14 billion richer on Thursday evening, February 3, after record-breaking results sent Amazon stock soaring.

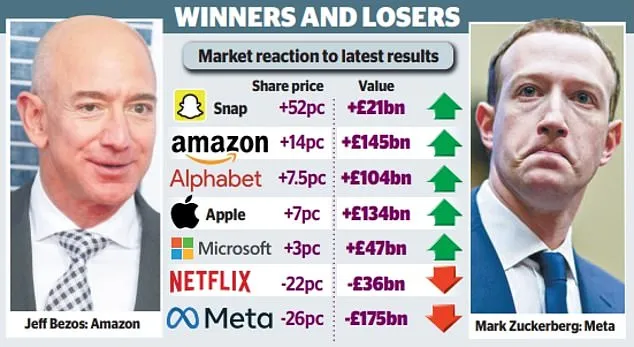

At the end of another turbulent week for technology stocks on Wall Street, the internet shopping giant’s shares rose 14 percent, adding £145 billion to its value.

The rise made Bezos – who founded Amazon in 1994 and ran the company until he passed the baton to Andy Jassy last year – some £14.5 billion richer.

His fortune stood in stark contrast to that of Facebook founder Mark Zuckerberg, who has taken a £23 billion blow since disappointing results caused shares in his company to tumble.

Facebook owner Meta saw its shares crash 26 percent on Thursday – wiping £175 billion of its value in the biggest one-day loss of market value of all time.

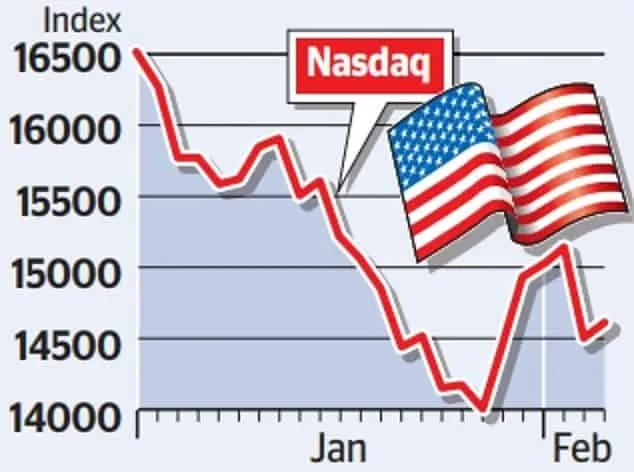

The tech earnings season came after a shaky start to 2022 on Wall Street as the prospect of higher interest rates rocked stocks in the sector. The tech-heavy Nasdaq has lost more than 10 percent of its value this year — putting it in so-called “correction” territory, though it remains 66 percent higher than early 2020.

Susannah Streeter, senior investment and market analyst at Hargreaves Lansdown, said: “The stomach-churning rollercoaster ride in the financial markets will continue.”

Bezos, 58, is the second richest man in the world with a fortune of £133 billion. Zuckerberg, 37, has now fallen out of the top ten, but is still said to be worth around £65 billion.

Their contrasting fortunes underlined the rise of winners and losers among the US tech giants as the world bounces from Covid19. While Facebook this week reported its first-ever user drop — sending stocks tumbling — Amazon posted £100 billion in revenue in one quarter.

Another company to benefit from bullish numbers was Snap Chat owner Snap, which gained 52 percent on Thursday after posting its first quarter profit. Apple, Microsoft and Google owner Alphabet have also posted strong gains in recent days — pushing their shares higher.

But streaming service Netflix saw its share plummet 22 percent in one day after it gained fewer new subscribers than expected.

Neil Wilson, chief market analyst at trading firm Markets.com, described the stock’s movements as “crazy” for such large companies.

The wild swings in the value of the so-called FAANG stocks – Facebook, Amazon, Apple, Netflix and Google – have been felt by UK savers and investors who own these shares wholly or are exposed through funds and mutual funds in pensions and ISAs.

One of the most popular is Scottish Mortgage Investment Trust, whose main holdings are Netflix and Amazon, as well as Moderna and Tesla. It is down nearly 20 percent this year.

Fundsmith ��– another broad-based fund run by Terry Smith – ranks Facebook and Microsoft among its largest holdings, while Polar Capital’s global technology fund houses Alphabet, Apple, Amazon, Meta and Microsoft.

Chris Beauchamp, chief market analyst at IG Group, said: “The market has seen technology earnings in recent weeks, with sentiment ravaged by the changing fortunes of some of the world’s largest companies.

“The industry continues to see a divergence between winners and losers, making it more difficult for investors to believe that FAANG stocks will remain a solid bet for future growth.”

source: thisismoney

Want to know more?

Related

blogs

Tech Updates: Microsoft 365, Azure, Cybersecurity & AI – Weekly in Your Mailbox.